Включить эту опцию для брокерского счета можно только fibo group в приложении Т‑Инвестиций версии 6.24. Ozon не берет комиссию за пополнение карты, но ее могут брать банки, со счета которых проводится зачисление, если выйти из бесплатного лимита. Сейчас платежные системы могут не принимать оплату с карт подсанкционных российских банков. После ввода десятого пакета санкций число таких банков пополнили Т-Банк, «Альфа-банк» и «Росбанк». Через несколько дней переводы через «Золотую корону» с карт этих банков стали невозможны. Это объясняется рисками ограничений для платежной системы со стороны ее партнеров.

Это можно сделать в личном кабинете на сайте tbank.ru, в приложении Т‑Инвестиций и терминале. При выводе денег с брокерского счета на карту Т‑Банка лимитов и комиссий нет. Через приложение сервиса также можно отправить деньги в Индонезию, Малайзию, ОАЭ и Сингапур, но это должен быть перевод на карту UnionPay. Сделать перевод можно через сайт или мобильное приложение, а также через пункты отправки, адреса которых также можно уточнить на сайте. Для отправления небольших сумм в личных целях сервисы переводов — доступный и рабочий вариант. Они позволяют отправлять деньги на счет или наличными между специальными пунктами.

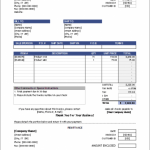

Комиссия за вывод средств для юрлиц

Выводится на счет карты Тинькофф в нужной валюте. Рассмотрим особенности вывода денег с индивидуального инвестиционного счета (ИИС) в Тинькофф Инвестиции. Выбираем валюту, валютный счет для зачисления и подтверждаем операцию. Комиссия не взимается, средства в пути от секунд https://fxtrend.org/ до минут.

Обычно биржа перечисляет клиенту деньги не сразу — это занимает до 3 рабочих дней, в зависимости от актива и режима торгов. Для Кыргызстана, Таджикистана, Узбекистана, Азербайджана и Молдовы через приложение возможен перевод по номеру телефона. Не все банки внутри доступных стран поддерживают платежную систему. Например, в августе 2022 года с «Золотой короной» перестал работать крупный белорусский «Белагропромбанк».

Закрытие ИИС и перевод средств на брокерский счет

- С телефона открыть еще один счет можно в приложении Т‑Инвестиций или в личном кабинете на tbank.ru.

- Помимо этого Тинькофф Инвестиции предоставляет удобные сервисы, позволяющие выводить деньги практически сразу в день совершения сделки.

- Рассмотрим, как можно закрыть брокерский счет, если он больше не нужен.

- Если есть подписка Premium или Private, комиссию не возьмут.

Основная масса российских банков по-прежнему не под санкциями, но от этого не легче. У многих из них проблемы с западными банками-корреспондентами, поэтому провести SWIFT-перевод без ограничений здесь тоже непросто. Чтобы вывести валюту, компания должна иметь расчетный счет в нужной валюте. НалогиПри выводе денег на карту мы должны удержать налог 13% с прибыли от инвестиций — это требование законодательства. Так как фактически деньги за сделку еще не поступили на счет с биржи, мы рассчитываем примерный размер налога, а если понадобится, скорректируем его, когда пройдут все расчеты. Что за «Вывод 24/7»Это услуга, с помощью которой можно моментально вывести рубли, доллары и евро сразу после продажи активов — круглосуточно и без выходных.

Большую сумму лучше разбить на 2-3 части и выводить в несколько этапов. Так счет будет доступен, но не будет отображаться на главной странице. Для компаний процедура вывода денег имеет свои особенности.

Актуальные способы вывода средств из Тинькофф Инвестиций

Для перевода через сайт и приложение понадобится банковская карта российского или иностранного банка. Но отправить валюту даже из подсанкционных российских банков все еще можно — в основном в «дружественные» страны. Например, Т-Банк переводит деньги в Армению, Казахстан, Беларусь, Таджикистан и ряд других стран. Все инвестиционные операции происходят на специально открытых счетах у брокера Тинькофф Инвестиции.

С телефона открыть еще один счет можно в приложении Т‑Инвестиций или в личном кабинете на tbank.ru. Вы пополнили брокерский счет на ₽ и купили акцию Х. Через некоторое время стоимость акции Х выросла на 1000 ₽ виды бирж и вы ее продали. Суммарная комиссия за сделки покупки и продажи — 15 ₽. Поэтому выгоднее использовать банки с возможностью пополнения в рублях.