This is crucial for providing investors and other stakeholders a bird’s-eye view of a company’s financial data. Many organizations structure their COAs so that expense information is separately compiled by department. Thus, the sales department, engineering department, and accounting department all what qualifies as a lease have the same set of expense accounts.

Synder’s QuickBooks Desktop Smart Rules Feature: Defining the Future of Accounting

- Today, the chart of accounts is an integral element of accounting software, and its use is widespread across various industries and organizations.

- Most accounting software has a set chart of accounts (CoA) when it is set up.

- Every time you add or remove an account from your business, it’s important to record it in your books and your chart of accounts (COA) helps you do that.

- To understand the chart of accounts, you might want to look at the concepts of accounts and general ledger.

- Similarly, the accounts listed within the chart of accounts will largely depend on the nature of the business.

- Additionally, integrating a COA into accounting software can further streamline financial management and reporting.

To check what information is needed, look at previous code details, which should help. The trial balance is helpful to see all the accounts on one report and is used mainly at the financial year-end. Implementing the principles mentioned can lead to the creation of a sound data model structure and common data definitions across an organization. As organizations look to leverage technology breakthroughs and position themselves to be data-driven, many are embarking on digital transformation programs with a focus on increasing ERP enablement.

Chart of Accounts Software

Current liabilities are any outstanding payments that are due within the year, while non-current or long-term liabilities are payments due more than a year from the date of the report. Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee (“DTTL”), its network of member firms, and their related entities. DTTL and each of its member firms are legally separate and independent entities.

The software handles the tracking of transactions across different accounts, ensuring real-time financial data is both precise and easily accessible. As your business grows, so will your need for accurate, fast, and legible reporting. Your chart of accounts helps you understand the past and look toward the future. A chart of accounts should keep your business accounting error-free and straightforward. This will allow you to quickly determine your financial health so that you can make intelligent decisions moving forward. Most new owners start with one or two broad categories, like sales and services, it may make sense to create seperate line items in your chart of accounts for different types of income.

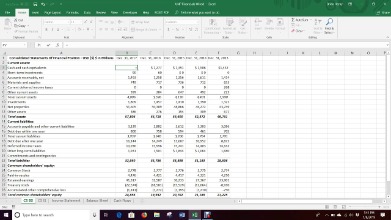

Example of an account numbering system:

Every time you record a business transaction—a new bank loan, an invoice from one of your clients, a laptop for the office—you have to record it in the right account. Below, we’ll go over what the accounting chart of accounts is, what it looks like, and why it’s so important for your business. Each category will include specific accounts for your business, like a business vehicle that you own would be recorded as an asset account. Every time how to use abc analysis for inventory management you add or remove an account from your business, it’s important to record it in your books and your chart of accounts (COA) helps you do that. Therefore, when crafting a chart of accounts, always consider the tax legislation, financial reporting standards, government regulations and other compliance requirements relevant in your circumstances.

This is because while some types of income are easy and cheap to generate, others require considerable effort, time, and expense. A chart of accounts (COA) is an index of all of the financial accounts in a company’s general ledger. In short, it is an organizational tool that lists by category and line item all of the financial transactions that a difference between incremental cash flow and total cash flow company conducted during a specific accounting period. In conclusion, integrating your Chart of Accounts with accounting software like QuickBooks Online significantly improves the efficiency and accuracy of financial management.

At this point, they demanded a more structured and standardized approach to accounting to help them track their finances, manage inventories, control costs, and assess their financial performance. Plus, keeping an eye on different expense types helps the company control its costs and ensure money is spent where it matters most. And when it comes to audits (those thorough checks of financial records), having a clear COA makes everything a lot easier, keeping everyone happy and following the rules.

We and our partners process data to provide:

Now, let’s explore a couple of the COA examples for businesses in various industries – online retail, manufacturing, and service businesses. We presume they accept online payments via payment platforms (for example, Stripe, Paypal, or Square). You might also notice that there are specificities of the business that might affect the COA structure.